Get the Word Out About Your Restaurant with American Express

Learn more about how American Express and Resy can boost your restaurant’s visibility through targeted marketing campaigns designed to attract high-value diners.

As an American Express company, we’ve created exclusive benefits that incentivize eligible Card Members to explore and discover Resy restaurants, helping you attract high-value guests.

Resy and American Express are teamed up to help bring more diners to your restaurant through unique programs. Card benefits like the Resy Credit incentivize millions of eligible American Express® Card Members to dine at U.S. Resy restaurants.1

And the hard part is already done for you: American Express® Card-accepting U.S. restaurants are included in this Resy Credit benefit at no additional cost, just by being bookable on Resy.

Check out the latest news about how Resy and American Express are teaming up to support our restaurants.

The state of the restaurant industry is, well, complicated. Over the last decade, restaurants have...

American Express ranked #10 on Fortune’s 2023 Wor...

Amex® Gold welcomes guests to experience Amex® Gold Café. Whether it’s to-go...

With Resy and American Express campaigns like Member Week and Shop Small®, your restaurant can get in front of diners eager to explore new places and support local businesses.

During Member Week, an annual celebration of American Express® Card Membership, Resy restaurants can be included in exclusive dining experiences for Card Members. It’s another avenue for Resy restaurants to reach guests and gain valuable exposure.

American Express’ ongoing initiative to support small businesses includes driving diners to visit local independent restaurants. When you’re with Resy, your restaurant can be included in Shop Small® promotions, like the Resy Tastemakers, connecting you with community-minded guests. Start with ensuring your restaurant is on the Shop Small Map, add or update your listing here.

Learn more about how American Express and Resy can boost your restaurant’s visibility through targeted marketing campaigns designed to attract high-value diners.

Access easy-to-use tips and tricks to help you market your restaurant to a broader audience.

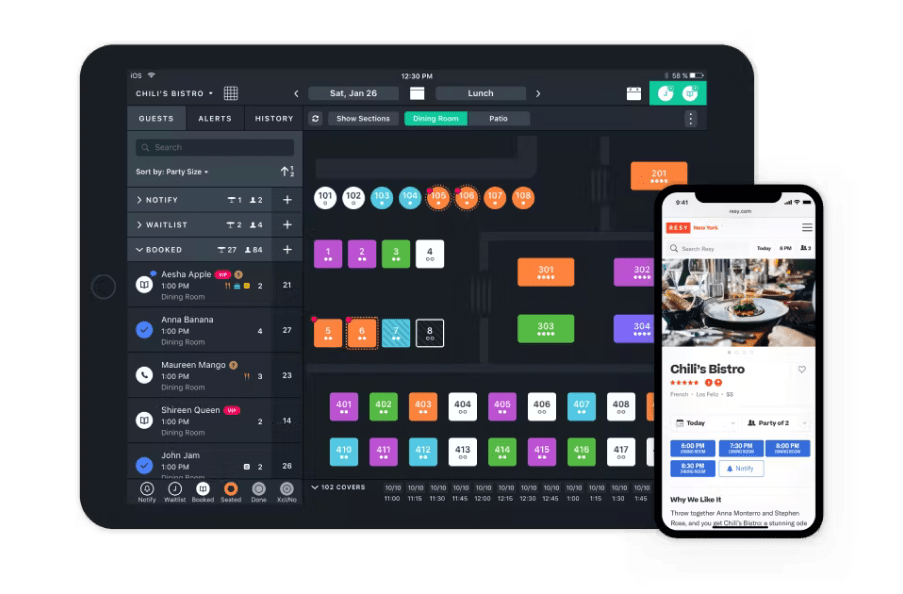

Resy, American Express and Tock help keep your tables booked and your seats filled with dedicated diners. We help grow your revenue, streamline your operations, and empower you to provide a consistently exceptional guest experience.